Fresh GDP numbers came in and it was a blowout. The kind of blowout that only a $2.7 trillion government deficit can buy while the private economy crumbles around it. Another couple blowout GDP reports like this and Americans will be living under an overpass.

There are two subjects about which Americans, in general, have demonstrated a historical lack of concern. The first is anything overseas, unless it is a war involving significant numbers of endangered American troops. The second is economic subjects any more complicated than the price of milk, gasoline, or household heat, light, and power - in other words, the drivers of their monthly expenses.

This sort of willful ignorance is the kind of thing very few nations in the history of the world have ever been able to enjoy. That Americans are able to do so is primarily a function of geography - we are, and nearly always have been - kings of the New World - certainly since the conclusion of the War of 1812, which was the last time a significant foreign power - England - waged a war on American soil that inflicted noticeable damage, in that case firing the US capital city and torching the White House.

Economics, often called “the dismal science” is another non-starter for claims on American attention for different reasons. We don’t pay attention to the furriners because, thanks to our oceans, we have not had to do so for well over two hundred years, and because threats from our fellow residents of the Western Hemisphere are so weak as to be essentially nonexistent in practical terms.

Economics, on the other hand, is a subject that is a, complicated, b, open to constant dispute among its own experts, c, requires a certain amount of learning that our public education system no longer automatically provides, and, d, for most, is difficult to hook up with their general understanding of how the world works. Trying to convince the average American that the cost of his breakfast cereal went up last month because of demand-pull inflation, but an identical rise in the price of Rice Sugar Soakers this month was caused by cost-push inflation will get you, at best, a stare of blank incomprehension, and at worst, a smack in the snoot. If you then try to convince him it is his fault that prices in general are going up because he expects them to go up, he’ll just stop listening to you altogether.

The final brick in that shithouse, however, is that inflation today bears little to no relationship to inflation, say, in 1960, for the simple reason that just about everything in the way inflation is calculated then versus now has been changed to make our institutions and our rulers look better than they would otherwise by making inflation appear to be lower than it actually is.

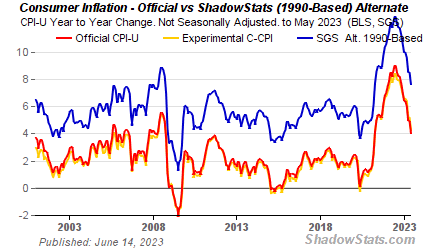

A very useful site called Shadowstats.com publishes “alternate” economic statistics based of methods of calculation used prior to 1990. The reports are broadly divided into five subject areas: Employment (unemployment), inflation, GDP, money supply, and the US dollar. Let’s take a look at inflation.

The CPI chart on the home page reflects our estimate of inflation for today as if it were calculated the same way it was in 1990. The CPI on the Alternate Data Series tab here reflects the CPI as if it were calculated using the methodologies in place in 1980. In general terms, methodological shifts in government reporting have depressed reported inflation, moving the concept of the CPI away from being a measure of the cost of living needed to maintain a constant standard of living.

Note that as currently calculated, inflation is running in the neighborhood of four percent, while as it used to be calculated, it is running about twice that. This accounts for the reason why, while you think just about everything you buy costs a lot more lately, official government statistics are used to assure you this is not the case, it is just your imagination. I mean, you wouldn’t argue that official government statistics don’t reflect reality (by which I mean lie), would you?

Well, the official government statistics on inflation as calculated in 1980 agree with your imagination, not the inflation lies currently being peddled by the US government and the media that supports it unthinkingly.

Okay, you say, but what does that have to do with the title of this essay and the subject of a “greatest depression?” First off, you have to understand there are, in general, two types of depressions - inflationary depressions and deflationary depressions.

A recession can be caused by two events. A decrease in demand or a decrease in supply. A decrease in demand causes prices to fall which is deflation. A decrease in supply causes prices to rise which is inflation. See the graphs below.

Examples of inflationary recession:

The 1973 oil crisis caused 'stagflation' in the US and triggered a recession. Link.

Examples of deflationary recession:

The Japanese asset price bubble of the 1980s has caused decades of deflation and low inflation in Japan. Link.

The Great Depression of the 1930s. Link.

Inflationary recession - aggregate supply falls which decreases output and causes prices to rise.

Deflationary recession - aggregate demand falls which causes prices to fall.

To which I add current examples of inflationary and deflationary recessions:

The inflation caused by Western sanctions and the resulting supply chain issues caused the supply of goods available in the US to fall, which caused prices to rise.

The deflation caused by locking up and otherwise discommoding large parts of the US during Covid caused demand to fall, which resulted in falling prices.

Since in many cases both situations were occurring at the same time, inflation showed up in some sectors while deflation dominated others.

As a rule of thumb, deflationary depressions are far more dangerous to governments and economies than inflationary ones because they can often result in deflationary spirals. Here’s America’s most notable example:

It is not much remembered today, but during the worst of the Depression years, a Communist revolution was considered a major threat by the Roosevelt administration, which expended much effort and capital in mitigating that possibility:

For all these reasons Marxism, the Soviet Union, and the various national communist parties enjoyed a prestige and a popularity through much of the 1930s that they had never possessed in the 1920s and would never again enjoy after the Great Depression.

The reason that deflation is more threatening to governments than inflation is that deflation is far more threatening to the underpinnings of a nation.

Deflation is when consumer and asset prices decrease over time, and purchasing power increases. Essentially, you can buy more goods or services tomorrow with the same amount of money you have today. This is the mirror image of inflation, which is the gradual increase in prices across the economy.

While deflation may seem like a good thing, it can signal an impending recession and hard economic times. When people feel prices are headed down, they delay purchases in the hopes that they can buy things for less at a later date. But lower spending leads to less income for producers, which can lead to unemployment and higher interest rates.

This negative feedback loop generates higher unemployment, even lower prices and even less spending. In short, deflation leads to more deflation. Throughout most of U.S. history, periods of deflation usually go hand in hand with severe economic downturns.

If a quarter of your populace is out of work, burdened with debt it cannot repay, losing homes, savings and, most important, hope, desperate measures may seem to be in order. If you believe that Capitalism is the cause of your agonies, trying a different system might seem like a logical move to make.

Inflation, on the other hand, while affecting the value of your currency, is much less destructive to your economy in general. If you own hard assets - real estate, precious metals, stocks, and so on, the value of your holdings will increase, often as much, or more than inflation reduces the value of the currency in your wallet.

Debt repayment will become easier, not more difficult. And even if your government sets the money printers on blast, creating an inflationary spiral, that may result in your paycheck having a bunch of new zeros on the end, but not necessarily that your paycheck will end entirely.

One of the most notable inflations of the modern era occurred in Zimbabwe. It destroyed that country’s currency, and damaged its economy, but the Mugabe government, whose corrupt and insane financial policies caused the inflation in the first place, still managed to ride out the episode and survive.

In short, in economic terms, inflation is a stimulant, while deflation is a poison. On top of that, as I noted earlier, governments find it easy to lie about inflation, to cover it up, and thus mitigate many of its effects.

But inflation is only one piece of the depressionary puzzle. The other is how we define a recession or depression in the first place.

Traditionally, we have defined a recession as two consecutive quarters when GDP contracts rather than grows. Traditionally, I say, at least until relatively recently when we had two consecutive quarters of GDP shrinkage in 2022, thanks to the Covid overreaction, but the Biden government assured us that did not actually mean we were in a recession, and found plenty of media “explainers” who agreed with that, and dug up “experts” who also did.

That given, I suppose that one way to cover up a depression would be for the responsible administration to simply refuse to admit that one exists. This might work for a Democrat-compliant/complicit media and the regulatory deep state with a Democrat administration, but would definitely fail if the administration happened to be Republican. Still, what makes a GDP grow or shrink? Let’s take a look:

Components of GDP: Explanation, Formula And Chart

Note that one of the four parts of the formula for calculating the American GDP is government spending. This has a couple of major implications. The first is that the US government can cause GDP to grow simply by spending more. The second is that the first is a bald-faced lie that only an economist would be stupid enough to believe.

Why? Look at the name of it, for chrissakes: Gross Domestic Product.

But government produces nothing. Governments impose and collect taxes, (on incomes since the ratification of the Sixteenth Amendment in February of 1913), and excise taxes, which have been constitutional since that document was ratified. The ability of the federal (and most state) government to levy excise taxes on basically anything they feel like and for any reasons that meets their whim seems almost fanciful. Corporations, for instance, can be taxed for the “privilege” of operating as corporations. But other types of business organizations could be taxed for the privilege of not being incorporated. Or for the privilege of dying the hair of their management purple, I suppose.

The most notable excise taxes are levied on booze and dope, in the form of tobacco, and…of course…firearms. You didn’t think the Bureau of Alcohol, Tobacco, and firearms got that moniker by accident, did you? These were quaintly called sin taxes in a time that had not yet achieved our current sophistication, let alone creativity, in the expansive nature of sin.

Federal excise taxes, in total, amount to not very much in America - a hundred billion or so per annum, which is now officially chump change in terms of government taxation. Most often they are used to punish businesses which the Great American Prude finds noxious - booze, dope, guns - but also oil, coal, gasoline, and other businesses certain powers would like to see go away, or at least shrink precipitately. Joe Biden raised the Superfund excise tax on toxic chemicals from the dead and reimposed it in somewhat altered form in 2021, for instance.

Americans understand that they pay income taxes because, if they pay attention, they see them deducted from their paychecks, although some don’t - there is an entire hilarious subgenre of TikTok displaying the outrage of Zoomers and Alphas upon discovering how little of their gross pay actually makes it through the tax grinders and into their suddenly shrunken wallets. Although I’d admit that the hilarity is probably in the eye of the beholder.

Most also know that they pay sales tax on things they buy, which seems odd if you think about it. Why don’t they call it purchase taxes, since you don’t pay it on stuff you sell, just on stuff you buy? (Yah, yah, I know - the buyer pays the tax, but the seller collects it on behalf of your benevolent government).

Hardly anybody is aware that excise taxes also come out of their pocket, one way or another, either in the cost of goods, or as added “fees” in those parts of monthly bills nobody pays any notice, mostly because they have no clue what they actually represent.

Anyway, that covers the taxing part of what government does, and it only sounds productive if your name if Hood Robin (Robin Hood reversed, for robbing the poor to give to the rich). And the feds spend every cent of that trying to cover the bills they’re already run up, a task at which they fail miserably. At this point they’ve pretty much given up the effort, with Biden proposing:

President Biden’s Budget Plan Makes the Government’s Fiscal Crisis Worse

The Biden budget promises to raise $65 trillion in revenues over 10 years, $5 trillion more than the baseline. The budget also promises to spend $82 trillion over 10 years, $2 trillion more than the baseline.

That math leaves a deficit of $17 trillion over 10 years. This is $3 trillion less than the baseline, so the White House is technically correct that Biden’s budget “reduces” the deficit by $3 trillion.

Almost 6.5 trillion dollars of spending (a third of which will be of non-existent “magic money) a year for the next decade, every buck of which will boost America’s (extremely) gross domestic product, even though all of it consists of either moving money from the taxpayers’ pocket to the government pocket, or creating “money” out of thin air and putting it in the government pocket. The government then spends this money buying…stuff…(in theory, at least) and that is where the purported productivity comes in.

Why, look at all the great…stuff… the recipients of money from the gubmint produce for America, crow the fans of this process - to whom the mere thought of taxpayers making their own decisions about how they would like to spend their money causes them to experience pustulent skin eruptions and itchy dentures.

The truth is that most of the money the government “spends” is in making good on all the things they’ve been bribed to do by the only constituents who actually matter to them - their donors, the bigger, the better. This would include the tens of thousands of tiny, or not so tiny, items scattered through dozens of pieces of legislation, often called earmarks, always called pork (every time I see this I think to myself, “In a pig’s ear…”), as well as the kind of back-scratching reacharounds to political slot machines and piggy banks (there’s that pig thing again) like education unions (who take a considerable percentage of the value they receive from their legislators and recycle it back to the same legislators in the form of PAC donations, and coolie laborers for the election cycles. Or via the trillion dollar military budget, which has taken to paying for enormously expensive weapons systems that are either obsolete before they are even off the drawing boards, or don’t work as advertised when they are finally delivered years late and over budget by 300%. You didn’t think all those MIC consultant slots, board seats, six-figure sinecures, and speaking engagements at $100k a pop for anybody with enough stars on their shoulders were going to just pay for themselves, did you?

So what does all this economic insider-baseballism have to do with depressions? For one - and perhaps the largest - effect is that they make our overall economy much more fragile, much more brittle, and much more likely to experience a deflationary, rather than inflationary, depression. Remember, we’ve experienced a lot of inflationary recessions - the entire decade of the 1970s could be characterized as such - but our only brush with a full-blown deflationary depression in the past century and a half has been The Great Depression.

The messaging from the Roosevelt administration during that period is instructive. Americans were told they had “nothing to fear but fear itself,” a little acorn of gibberish from which a mighty tree of bullshit grew. The contention behind the cliche was that this “depression” was primarily caused by the fear of Americans to spend money, rather than the wholesale destruction of banks and the vaporization of their assets - you know, the deposits entrusted to them by those now stupidly fearful losers who watched as their life savings evaporated into thin air, while the only thing the government could find as a remedy was to tell them it was their fault for being scaredy-cats who refused to pump money into the economy.

Money they no longer had, because they entrusted it to a banking system riddled with corruption, ostensibly overseen by a Federal Reserve in a prime case of the fox guarding the hen coop.

The lies, from back to front, top to bottom, side to side, and from then to now have been unceasing. Why is this so important, aside from the encouragement of a psychotic denial of reality on the part of all concerned? Because the bone deep dishonesty of our metasystem - that system of all systems that oversees and attempts to control every aspect our our lives and anything that conceivably could affect our entire existence in any possible way - has been allowed to reach terminal complexity without anybody being the wiser.

And that will be the subject of the second part of this essay, No Lie - How Complexity May End Up Killing Us All In the Greatest Depression.

Economics to me is money in money out. I don't want to make it more complicated because it hurts. Inflation can be summed up by having to go further or digging deeper for resources just to keep the wheels on the bus turning. At some point the system fails and/or is replaced by a new system. What has happened more recently since the industrial revolution is that we pile new systems on top of the old ones thereby giving the impression that some kind of progress is happening. Which it is... I guess... but there comes a point where anyone who stops to look around starts to wonder what the hell we're actually trying to achieve beyond putting food on the table and buying a bigger truck. I mean... is there a plan... other than the now blatantly obvious eugenicist technocracy that is unfolding and somewhat being rejected as people start to recognize it for what it is.

We'll get through the ups and downs of economic bumps in the road. The system will readjust and drop some ballast. I just want to know if anyone has pinned a plan to the wall that is worth a damn because for now it seems to me that it's every man for himself until further notice. I say this because every time someone comes along with a really awesome plan (seems to be Elon's turn) things never go as intended and sometimes it ends up with everyone fighting everyone else just because. It looks like that is what's on the table again either as a coverup or because there really is no other way out of the economic mess that we get ourselves into.

Deflation was so damaging during the 30s because the government tried to fight deflation with assorted price controls. The government was destroying food and limiting farm production in order to raise the price of farm goods at the same time people were going hungry. This is also the era of minimum wages and enhanced union power. Raise the price of labor when people are unemployed. Smart!

(And an overleveraged financial system didn't help either.)

There was extended price deflation during the late 1800s which corresponded to massive prosperity.

Conversely, the inflation of the 70s was exacerbated bigly by Nixon's price controls. We had the oil, but it wasn't worth pumping due to inflation coupled with price controls.