This accurate recession indicator is flashing red, but the ‘Sahm Rule’ creator says ‘this time really could be different’

The weak July jobs report just triggered one of the most well-known, and historically accurate, recession indicators: The Sahm Rule. But the rule’s inventor, Claudia Sahm, pushed back against the plethora of doomsday narratives that gained traction after its triggering on Friday.

How historically accurate? This historically accurate:

The Sahm Rule Recession Indicator Definition and How It's Calculated

How Accurate is the Sahm Rule? The rule has proved to be very accurate with the indicator always triggering in the early stages of a recession and never outside of one since the 1970s.

There is a wry form of a joke among economics prognosticators when discussing various predictive mechanisms, along the lines that, "This indicator has predicted every (event) since 19XX, as well as 36 (events) that didn't happen.”

The point is that a really useful predictor needs to be specific in its accuracy, by predicting only events that do occur, and not predicting the same type of event that fails to occur.

The Sahm Rule has hit that standard of accuracy - predicting recessions that did occur, and not predicting recessions that didn't occur - for more than fifty years. We have no other such mechanism with that good a record. We do have some that come close, though. The inverted yield curve is one such.

What is the inverted yield curve?

This Recession Indicator Has Been Accurate Since 1955: Here's What It Says Now | The Motley Fool

While predicting recessions is difficult at best, the U.S. Treasury yield curve has been a relatively reliable indicator in the past. Specifically, the three-month Treasury bill and the 10-year Treasury note have undergone a yield curve inversion before every recession since 1955, and that portion of the yield curve is once again inverted.

Top put it even more simply, when short term interest rate payments on bonds are higher than long term bond interest rate payments, the yield curve is inverted - ie., upside down. Because long term bonds are a riskier investment than short term bonds, they should pay the owners of such bonds a higher rate of interest to compensate them for the higher risk they are undertaking.

When the opposite occurs, it means that investors are selling longer term bonds (which forces down their interest payments), and buying shorter term bonds instead (which forces those bond interest payments higher because of the demand for them). The reason investors might do this is that they are worried about the more distant future, and don't want to be locked in to longer term investments that might suddenly drop in value leaving them no way out except to take a loss. There is much less risk of that happening with extremely short term investments like three month Treasury bills, hence the demand for them in such situations.

CORRECTION: I have that precisely backwards, because I confused interest rate and price. Increased demand for bonds pushed prices up, and hence interest rates down. The yield curve “inverts” when increased demand for long term bonds pushes their interest rates (yields) below those of short term bonds, which suffer from falling demand and increased interest rate yields. Much more here:

Inverted Yield Curve: Definition, What It Can Tell Investors, and Examples

Using the traditional definition of an inverted yield curve - the Ten Year Note yielding less than the Three Month Bill - the yield curve has been inverted since October of 2022, or nearly two years at this point. This is the longest such inversion on record. Yet, we are told, "a recession has not materialized."

By the same token, Claudia Sahm is currently backpedaling furiously against the meaning of the indicator she created, the most accurate indicator of an imminent recession ever discovered.

“This time really could be different,” Sahm said. “[The Sahm Rule] may not tell us what it's told us in the past, because of these swings from labor shortages, with people dropping out of the labor force, to now having immigrants coming lately. That all can show up in changes in the unemployment rate, which is the core of the Sahm Rule.”

This leaves Americans who pay some attention to the economy's technical underpinnings, (a distinct minority, since most Americans are unaware such underpinnings even exist) in confusion. What to believe? Indicators that have been mostly or entirely accurate for a minimum of fifty years, or the chorus of voices that have sprung up in government and media saying those indicators are now wrong and should be disregarded? This time, despite all past history, "it really is different?"

“The four most expensive words in the English language are, ‘This time it’s different.’”

Heed Sir John's advice. Because the rat in this stinking woodpile of corrupt propagada being served up to you by the Big Liar/Media complex is that no recessions have occurred. Is that true?

What is a recession and how is it defined? Explainer | World Economic Forum

In 1974, US economist Julius Shiskin described a recession as “two consecutive quarters of declining growth”, and many countries still adhere to that.

However, the US has since opted to use a more open definition. (More on this in a moment).

And has such a thing occurred in the same general time frame as these warnings that have been flashing? Why, yes. Yes, it has:

After 2 Straight Quarters of Negative GDP, Is America in a Recession?

That's what the Biden administration is about to find out, following the release on Thursday morning of a report from the Bureau of Economic Analysis (BEA) showing that the United States has endured back-to-back quarters of negative economic growth—a situation that meets the standard definition of a recession.

But, as this news was announced, a mighty chorus arose from the gaggle of Big Liars/Propagandists that make up the Ruling Class' pool of "expert" economists. "No recession," they shouted in unison. "The National Bureau of Economic Research's Business Cycle Dating Committee has not declared a recession."

Eh? How is that, you say? We've just seen two consecutive quarters - that's six months - of shrinking Gross Domestic Product - which has been the accepted definition of a recession for going on fifty years. But the NBER's Business Cycle Dating Committee did not declare this period as a recession. Nor did it ever. Joe Bidenomics was at work saving the economy and, incidentally, saving the 2022 mid-terms for the Democrat Party to steal.

Of course, while there was only a single quarter in 2020, under President Trump, in which GDP contracted due to the Corona Plandemic Panic, that was a recession. See what a "more open definition of a recession" buys you?

And none of this addresses the biggest elephant taking a dump in the middle of the economic living room: The dishonest and corrupt way the United States government and its sycophant economic "experts" calculate the national Gross Domestic Product, or, as Alex Macris calls it, the Gross Domestic Fraud.

Do click the link over to Alex’s place and check out the entire essay, but the Too Long, Didn’t Read version is something like this:

The Gross Domestic Fraud Ultimately Just Defrauds America

Benjamin Disraeli is reputed to have remarked “There are three kinds of lies: lies, damned lies, and statistics.” By Disraeli’s standards, GDP, as calculated today, is all three kinds of lie.

Were GDP simply a technical measurement that was cautiously deployed by economic experts in academic papers, its miscalculation and misuse would be irritating, but not catastrophic. Unfortunately, GDP has become the central measure by which policymakers gauge economic strength and prosperity. That has led to terrible policy errors.

For the last 50 years, we have deindustrialized our economy, thereby destroying its actual productivity, all while fooling ourselves into believing that our economy is becoming more productive because the sum of our economic transfers on non-productive land rent or interest charges are going up.

We have persuaded ourselves that replacing the single-income household with a stay-at-home caregiver with a double-income household creates a great increase in prosperity; that homeschooling our children harms economic growth; that being charged high interest rates represents receiving a valuable service; and that asset inflation in home prices due to foreign ownership is making us a more productive nation.

And, since the beginning of the Russo-Ukraine War, we have overestimated the strength of American sanctions and underestimated the productive capacity of the Russian economy, because our leaders mis-used GDP to assess the warfighting power of our nation and our adversary.

When President Joe Biden said, “Russia's economy is less than one-twentieth the size of the U.S. economy. It’s smaller than that of Italy, France, or the United Kingdom,” he was relying on GDP.

When Senator Lindsey Graham said, “Russia is a gas station masquerading as a country. Its economy is smaller than that of Texas,” he was relying on GDP.

Were they lying? A liar knows he is misrepresenting the truth, a bullshitter often believes his own bullshit. President Biden and Senator Graham weren’t lying when they made these claims; they were believing what GDP told them. But GDP is bullshit.

And after nearly fifty years of massaging just about all the calculations for our primary economic indicators like inflation, unemployment, and GDP in order to make our Ruling Class look good, it has become futile to try to get an accurate picture of what is actually going on with our economy.

We are left with contemplating these sorts of things:

I came back from Kroger’s yesterday afternoon after purchasing one loaf of low-carb bread, 1/2 gallon of coconut milk, one pound of store brand butter, and two 12 ounce packages of store brand pepper jack cheese slices. All but the coconut milk were offered “on sale.” Total cost? $22.65.

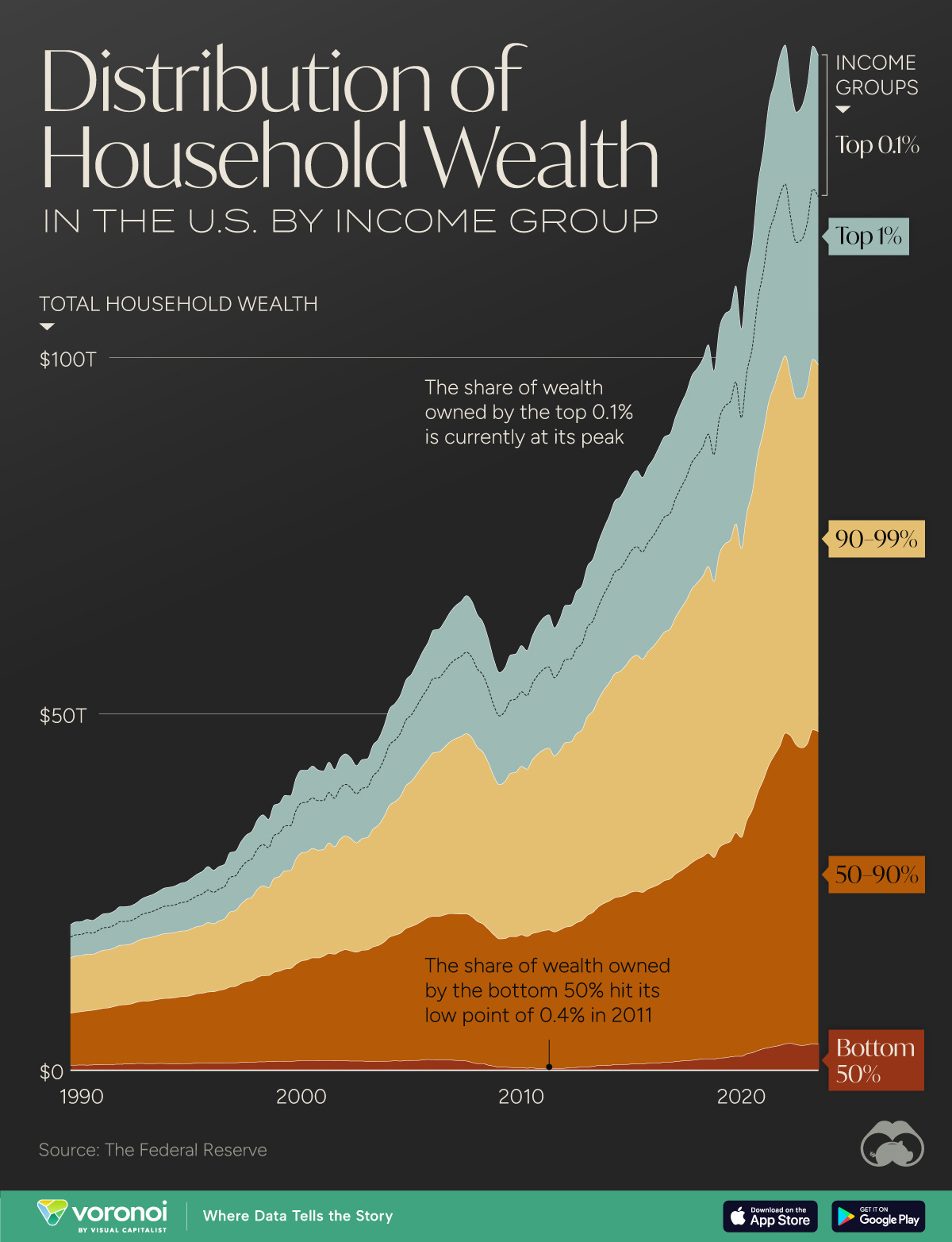

Meanwhile, the class of folks who tell us that inflation is not a factor enjoy their perch atop this chart:

Erratum: when investors sell long term bonds it increases their yield. Low price == high yield.